Ira withdrawal calculator 2021

TRADITIONAL IRA For the 2021 tax year. For a Traditional IRA you can contribute up to 6000 for the tax year 2021 and 6000 for the tax year 2022 or up to 100 of earned income whichever is less.

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

If you want to simply take your.

. Ad Contact Mariner Wealth Advisors for Help Planning Your Retirement. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. And from then on.

Find Out How We Approach Retirement Planning. Subaru legacy used morristown vermont stacy brown cabelas cot tent. Individuals age 50 and over can.

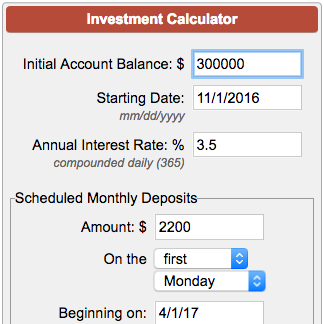

The IRA Withdrawal Calculator is based on Table II Joint Life and Last Survivor Expectancy and Table III Uniform Lifetime Table from IRS. Use this calculator to determine your required minimum distributions RMD from a traditional IRA. Currently you can save 6000 a yearor 7000 if youre 50 or older.

Account balance as of December 31 2021. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Amount You Expected to Withdraw This is the budgeted. This means you must use the Joint Life and Last Survivor Expectancy table to calculate your RMD. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

How is my RMD calculated. You must take your first RMD for 2021 by April 1 2022 with subsequent RMDs on December 31st annually thereafter. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement.

This tool can calculate your RMDs from a traditional IRA. Use our IRA calculators to get the IRA numbers you need. Learn More About American Funds Objective-Based Approach to Investing.

Ira withdrawal calculator 2021. The maximum SEP IRA contribution is the lesser of 25 of adjusted net earnings or 58000 for 2021 61000 for 2022. Terms of the plan.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs. Unfortunately there are limits to how much you can save in an IRA.

Expected Retirement Age This is the age at which you plan to retire. You reached age 72 on July 1 2021. Calculate your earnings and more.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. 2022 Early Retirement Account Withdrawal Tax Penalty Calculator. While you turn 73 in 2021 your spouse turns 58 in 2021.

Calculate your earnings and more. Required Minimum Distributions Update 2021 Fcmm Benefits Retirement. Based on the table your distribution.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

How the IRA Withdrawal Calculator Works. 2022 lexus es 250. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Use this worksheet for 2021. Your life expectancy factor is taken from the IRS. Retirement Withdrawal Calculator Terms and Definitions.

Since you took the withdrawal before you reached age 59 12 unless you met one. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. The threshold is anything above.

How To Calculate Gross Income Per Month

Retirement Savings Calculator

Td Retirement Calculator

Required Minimum Distribution Calculator

How To Calculate Rmds Forbes Advisor

Rmd Calculator Required Minimum Distributions Calculator

Rmd Table Rules Requirements By Account Type

Employee Cost Calculator Quickbooks Quickbooks Calculator Employee

Retirement Withdrawal Calculator For Excel

Calculate Your Net Worth The Only Financial Number That Matters Net Worth Budgeting How To Plan

Investment Account Calculator

Roth Ira Calculator Excel Template For Free

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

How To Calculate Income Tax In Excel

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

Retirement Savings Calculator

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account